At Tribeca Pediatrics, no patient will ever be denied medical care because of an inability to pay. To help ensure access to care, we offer a Sliding Fee Discount Program for those who qualify.

Patients approved for the Sliding Fee Discount Program will be charged a nominal fee of $30 per visit for services under the program.

Eligibility for this program is based on household income and family size. Verification of income is required, and this information must be updated annually to continue participation. All information provided is used solely to determine eligibility for the discount and is kept strictly confidential.

If you would like to apply, please complete the application before scheduling your appointment or returning to your location.

Eligibility Determination

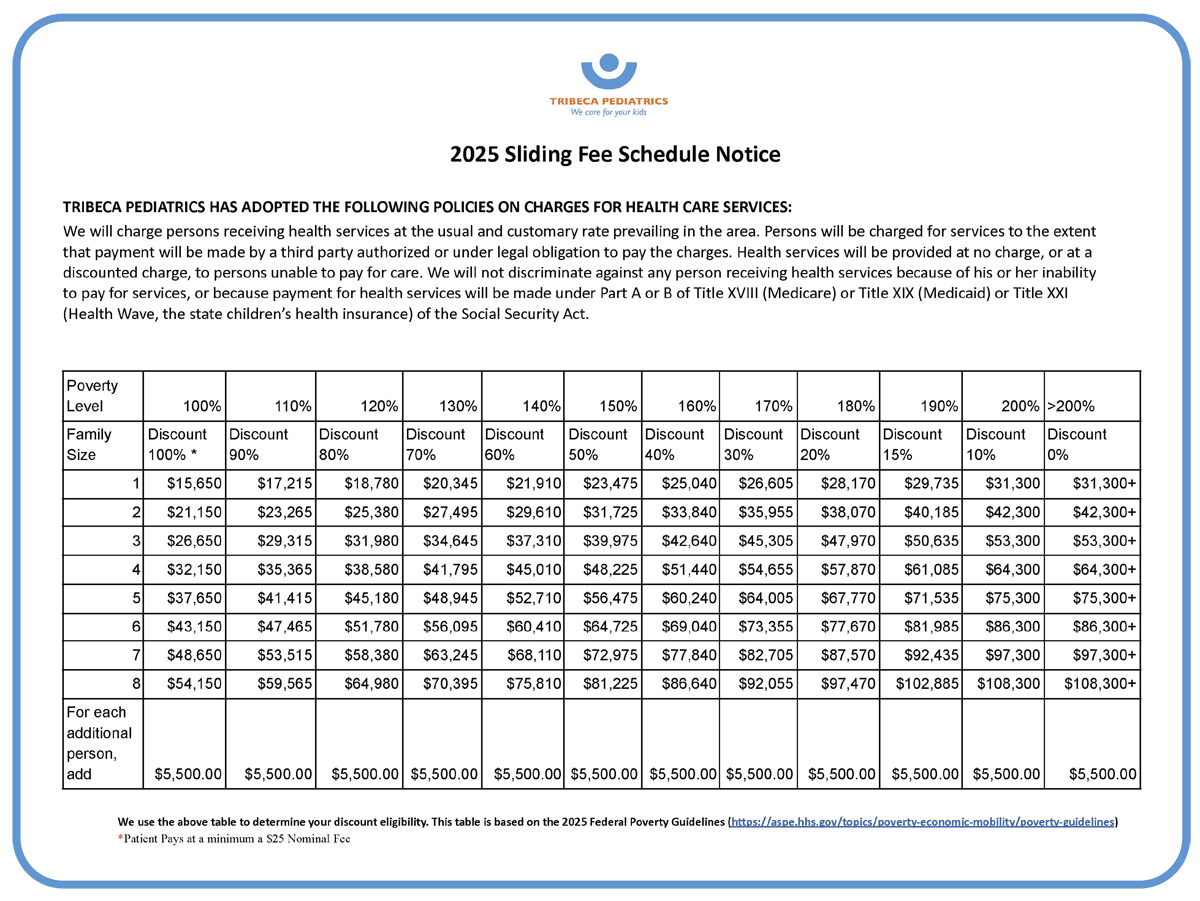

Eligibility for the Sliding Fee Discount Program is determined based on household size and annual income. An application must be completed and proof of income is required. Discounts are applied based on federal poverty income guidelines, updated annually by the federal government. Recertification is required annually or when changes to family size or income occur. Once you have been approved for the Sliding Fee Discount Program, you will remain active in the program for one year.

Tribeca Pediatrics identifies the definitions of a household and income as below:

Household Size: one person or a group of people, who may or may not be related, living (or staying temporarily) at the same address and share common housekeeping responsibilities, and either share at least one meal a day or share common living accommodation (i.e. a living room or dining room).

Income includes: earnings, unemployment compensation, workers’ compensation, Social Security, Supplemental Security Income, public assistance, veterans’ payments, survivor benefits, pension or retirement income, interest, dividends, rents, royalties, income from estates, trusts, educational assistance, alimony, child support, assistance from outside the household, and other miscellaneous sources. Noncash benefits (such as food stamps and housing subsidies) do not count.

Sliding Fee Discounts are determined by using:

- Federal Income Tax forms

- One month of consecutive pay stubs or letter of salary

- W-2’s

- Unemployment Benefits

- Social Security Benefits

- Self-declaration options are also available